Website - Definition of Terms

- Ad Valorem Tax (According to Value) -A tax that is imposed on the value of property, real or personal.

- Appeal - When a taxpayer feels as though his/her property has been assessed incorrectly, they can appeal or petition the assessment.

- Appraisal - An estimate of the value of real and personal property.

- Bankruptcy - When an individual or organization is declared financially insolvent by the Bankruptcy Court. There are 4 different types of Bankruptcy-Chapter 7, Chapter 11, Chapter 12 and Chapter 13.

- Delinquent Taxes - Any tax that is not paid by the due date.

- Exempt - Some properties are exempt from paying taxes such as cemeteries, churches, and governmental agencies.

- Execution - Form used for levying on and selling the delinquent taxpayer’s property to satisfy unpaid taxes.

- Execution Docket (The Tax Commissioner’s Execution Docket) - Listing of recorded Fi Fa’s.

- Fieri Facias (Fi. Fa.) - A judicial writ directing the sheriff to satisfy a judgment from the debtor’s property. Applies to personal and real property. This term is used interchangeably with execution.

- Motor Vehicle - A self-propelled wheeled conveyance, such as a car or truck that does not run on rails.

- Mobile Home (Manufactured Home) - A single family dwelling unit, constructed on an I-beam, prefabricated and designed to be transported on its own wheels, a flat bed, trailer or on detachable wheels.

- Personal Property - All property that is not real estate, i.e. boats, motors, tractors, farm equipment and machinery.

- Real Property - Land and anything erected, growing or affixed to the land.

- Tax Digest - A compilation of all property lying or being in the county. The Tax Digest is prepared every year.

Ad Valorem Tax Process

Ad valorem tax, more commonly known as property tax, is a large source of revenue for local governments in Georgia. The basis for ad valorem taxation is the fair market value of the property, which is established as of January 1 of each year. The tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value unless otherwise specified by law (O.C.G.A. 48-5-7). Fair market value, means "the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arm's length, bona fide sale. "(O.C.G.A. 48-5-311) The amount of tax is determined by the tax rate (mill rate) levied by various entities (one mill is equal to $1.00 for each $1,000 of assessed value, or .001).

Several distinct entities are involved in the ad valorem tax process:

- The State Revenue Commissioner is responsible for examining the tax digests of counties in Georgia in order to determine that property is assessed uniformly and equally between and within the counties (O.C.G.A. 48-5-340). In addition, the State levies ad valorem tax each year in an amount which cannot exceed one-fourth of one mill(.00025).

- The County Board of Tax Assessors, appointed for fixed terms by the county commissioners, is responsible for the appraisal, assessment, and the equalization of all assessments within the county. They notify taxpayers when changes are made to the value of property, receive and review all appeals filed, and ensure that the appeal process proceeds properly. In addition, they approve all exemptions claimed by the taxpayer.

- The County Board of Equalization, appointed by the Grand Jury, is the body charged by law with hearing and adjudicating administrative appeals to property values and assessments made by the Board of Tax Assessors.

- The Board of County Commissioners, an elected body, establishes the annual budget for county government operations and levies the mill rate necessary to fund the portion of the budget to be paid for by ad valorem tax.

- The County Board of Education, an elected body, establishes the annual budget for school purposes and adopts the mill rate necessary to fund the portion of the budget to be paid for by ad valorem tax.

- The County Tax Commissioner, an elected office established by the Constitution, is the official responsible for performing all functions related to billing, collecting, accounting for and disbursing ad valorem taxes collected in this county. The Tax Commissioner also serves as an agent of the State Revenue Commissioner for the registration of motor vehicles.

Tax Bills

Generally, Catoosa County property taxes are due by December 20. If taxes are not paid on the property, it may be levied upon and ultimately sold. Taxes for the City of Ringgold and City of Ft. Oglethorpe are included on the county tax bill.

Tax Returns

Taxpayers are required to file at least an initial tax return for taxable property (both real and personal property) owned on January 1 of that tax year. The tax return is a listing of the property owned by the taxpayer and the taxpayer's declaration of the value of their property.

Property tax returns must be filed with the Board of Tax Assessors between January 1 and April 1 of each year. (Please note: the filing deadline for homestead exemption is April 1). After the taxpayer has filed the initial tax return for real property, the law provides for an automatic renewal of that return each succeeding year at the value determined for the preceding year and the taxpayer is required to file a new return only as additional property is acquired, improvements are made to existing property, or other changes occur. Personal property tax returns are required to be filed each year.

A new return, filed during the return period, may also be made by the taxpayer to declare a different value from the existing value where the taxpayer is dissatisfied with the current value placed on the property by the Board of Tax Assessors. This initiates the taxpayer's appeal process if the declared value is not accepted by the Board of Tax Assessors.

Assessment Appeals

When the Board of Tax Assessors changes the value of property from the value in place for the preceding year or from the value that was returned by the taxpayer for the current year, a notice of that change must be sent to the property owner. The property owner desiring to appeal the change in value must do so within 45 days of the date of mailing of this assessment notice. The assessment appeal may be made on the basis of the taxability of the property, the value placed upon the property, or the uniformity of that value when compared to other similar properties in the county. Additionally, the appeal should not be based on any complaint about the amount of taxes levied on the property.

When a property owner files an initial appeal, the owner must declare their chosen method of appeal. The three methods of appeal are: Board of Equalization, Hearing Officer or Arbitration. More details for each of these methods is available from the Board of Tax Assessors or from the Department of Revenue's website:

http://dor.georgia.gov/.

Homestead Exemption

Homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence. Homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value).

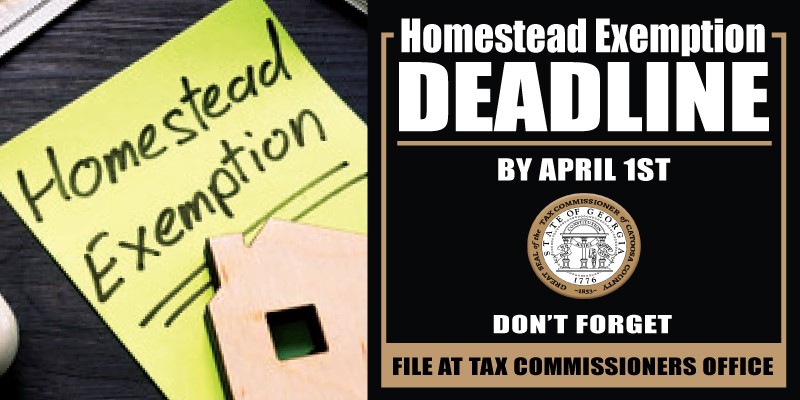

To receive the benefit of the homestead exemption the taxpayer must file an initial application. In Catoosa County the application is filed with the Tax Commissioner's Office. First time homeowners need to bring a copy of their warranty deed to ensure their application is filed correctly. With respect to all of the homestead exemptions the Board of Assessors makes the final determination as to eligibility; however, if the application is denied the taxpayer must be notified and an appeal procedure is then available to the taxpayer.

Georgia law allows for the year-round filing of homestead applications but the application must be received by April 1 of the year for which the exemption is first claimed by the taxpayer. Homestead applications received after that date will be applied to the next tax year.

Once granted, the homestead exemption is automatically renewed each year and the taxpayer does not have to apply again unless there is a change of residence, ownership, or the taxpayer seeks to qualify for a different kind of exemption.

Under authority of the State Constitution several different types of homestead exemptions are provided. These are called State Exemptions. In addition, local governments are authorized to provide for increased exemption amounts. These are called Local County Exemptions. Catoosa County has such local county exemptions. The Local County Exemptions supersede the State Exemptions when the Local Exemption amount is greater than the State Exemption amount. The Tax Commissioner's office and Tax Assessor's Office can answer questions regarding the standard exemptions as well as any local exemptions that are in place.

Available Catoosa County Homesteads (these are State & Local exemptions combined)

Georgia ID required for all Homestead exemptions.

REGULAR HOMESTEAD EXEMPTION:

- No income requirements

- $2,000 for State, County and School Purposes

VETERANS EXEMPTION:

- Must be 100% disabled-service connected

- Letter from Veteran Affairs verifying disability

- Unremarried surviving spouse or minor children may also qualify

- Currently this exemption amount is $100,896

SENIOR EXEMPTIONS:

- Local School Exemption #1 - Owner must be 62 prior to January 1 of the year applied for. There is no income limit. This is a $2,000 exemption off the school tax assessment.

- Local School Exemption #2 - Owner must be 75 prior to January 1 of the year applied for .There are no income restrictions. This is a total school tax exemption. No multiple homes on property.

- Local Disability Exemption Under 62 - The owner must be permanently disabled per the Social Security Administration and have a gross household income of less than $20,000 (increased from $14,000, effective January 1, 2009). This is a $30,000 exemption off the county and school tax assessments.

- Local County Tax Exemption (Effective January 1, 2009) - The owner must be 62 or over prior to January 1 of the year applied for and have a gross household income of less than $20,000. This is a total county tax exemption.

- Local Age 65 exemption for residents with Federal Adjusted Gross Income $30,000 or less. Proof of income required.

- Please call 706-965-2571 for additional information about homestead exemption requirements and eligibility.

Property Tax Deferral Program

In addition to the various homestead exemptions that are authorized, the law also provides a Property Tax Deferral Program whereby qualified homestead property owners 62 and older with gross household income of $15,000 or less may defer but not exempt the payment of ad valorem taxes on a part or all of the homestead property. Generally, the tax would be deferred until the property ownership changes or until such time that the deferred taxes plus interest reach a level equal to 85% of the fair market value of the property.

Specialized and Preferential Assessment Programs

Two general types of specialized or preferential assessment programs are available for certain owners of certain types of property. One of these programs authorizes assessment at 30% rather than 40% of fair market value for certain agricultural properties being used for bona fide agricultural purposes.

The second type of preferential program is the Conservation Use program which provides that certain agricultural property, timber land property, environmentally sensitive property, or residential transitional property is to be valued and assessed for ad valorem tax purposes at its current use value rather than its fair market value.

Each of these specialized or preferential programs requires the property owner to covenant with the Board of Tax Assessors to maintain the property in its qualified use for at least 10 years in order to qualify for the preference. The Board of Tax Assessors can explain the ownership and use restrictions regarding property qualifying for either of these programs.

Rehabilitated and Landmark Historic Property

Historic property that qualifies for listing on the Georgia National Register of Historic Places may qualify for preferential assessment. The preferential assessment shall extend to the building or structure, the real property on which the building or structure is located, and not more than two acres surrounding the building or structure. The Board of Tax Assessors can explain the ownership and use restrictions regarding property qualifying for this assessment.

Brownfield Property

Property which qualifies for participation in the State's Hazardous Site Reuse and Redevelopment Program and which has been designated as such by the Environmental Protection Division of the Department of Natural Resources may qualify for preferential assessment. This special program provides for the preferential assessment of environmental and contaminated property by freezing the value for ten years as an incentive for developers to clean up the property and return it to the tax rolls. The Board of Tax Assessors can explain the ownership and use restrictions regarding property qualifying for this assessment.

Timber

Standing timber is not taxed until sold or harvested, at which time it is taxed based upon 100 percent of its fair market value. This value is then multiplied by the appropriate mill rate to determine the tax amount due.

Mobile/Manufactured Home Permits

Owners of mobile homes that are located in Catoosa County on January 1 must pay the ad valorem taxes on the home by April 1 of each year and obtain their location permit at that time. Failure to pay the taxes and obtain the permit will result in a 10% tax penalty. Failure to pay the taxes and obtain the permit will result in a 10% tax penalty, issuance of a fifa, and possible sale of the mobile/manufactured home.

Mobile home owners desiring to declare a different value from the existing value on the home have 45 days to file an appeal with the Board of Tax Assessors. If a taxpayer is dissatisfied with the value change or corrections, the taxpayer has the right to appeal to the Board of Equalization within 21 days of the date of the notice.

Freeport Exemptions for Businesses

Manufacturers may qualify for Freeport Exemption on one or more of three categories. The categories are raw goods, goods in process and manufactured goods stored in warehouse to be shipped out of state. Specific detailed information is available and applications must be filed with the Board of Tax Assessors between January 1st and April 1st each year.

For further information regarding property taxation in Georgia, please visit the State of Georgia Local Government Services Division website at

http://dor.georgia.gov/.